Credit Card Processing might actually be one of the most frustrating industries in the modern world. Look, First Payment Services has been in the processing business for 15 years, I can promise you, CC processing doesn’t need to be that confusing.

What if I told you that processors have the option to make their statements simple or confusing?

What if I told you that credit card processing, as an industry, is actually rather simple?

If you’re interested in demystifying the basics of credit card processing, then that’s exactly what you’ll learn here. If you like what you learn, then drop us a line and fill out our contact form. If you choose to work with us, we’ll be just as transparent as we are in our credit card processing guides.

Without further ado, let’s begin with a simple breakdown of what actually happens behind the scenes as you swipe a credit card at your favorite trendy coffee shop with its rotating iPad point of sale. Hopefully, by the end of this, you’ll be able to tell all your friends how credit card processing works (but maybe you’ll just keep that to yourself since friends aren’t normally interested in that sort of thing).

Table of Contents

Credit Card Basics

1. The Issuer: This group provides credit cards to consumers and produces and delivers the monthly credit card statements to consumers. Here’s a small list of the top 8 by market share (according to the 2017 Nilson Report):

- American Express

- JPMorgan Chase

- Citibank

- Bank of America

- Capital One

- U.S. Bank

- Discover

- Wells Fargo

Something to note about two of bulleted items: The Network and Card Issuer are a single entity in the case of American Express and Discover. This is called a ‘Closed-Loop’ transaction. Transactions that use the Visa or MC Networks are considered ‘Open Loop’.

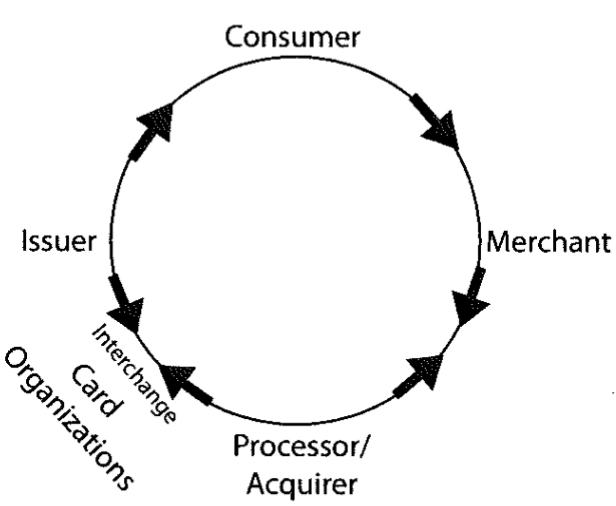

2. The Card Organizations: These are the companies that conduct clearing and settlement processing of transactions. If you live in America (or just about anywhere in the world), you’ll probably have one of these in your wallet or purse. The primary card organizations are – Visa, Mastercard, Discover, and American Express.

Card organizations sit between issuers and processors/acquirers where interchange takes place. No worries, I’ll explain what this means very soon.

3. The Processor or Acquirer (this is what First Payment Services is): These are companies that provide merchants a means to accept money transfer via credit or debit by processing the card transactions.

This is why we’re called a credit card processor. The payment information is processed and transferred to the banks and the card organizations and all of that information is instantly relayed back to the processor at the point of sale. In my earlier example, this would be the Ipad in front in the coffee shop.

4. The Merchant: Any entity offering goods or services for sale. A merchant is just another name for a business.

How does Credit Card Processing Work: Making Sense of a Transaction

The easiest way to explain this diagram is to dig into our coffee shop example. You order a latte. The Cashier takes your card and charges you $4. You see a message that says “approved.”

This is what just happened –

- The card swipe records your information to the coffee shop.

- The merchant reports the swipe, along with all the information gathered from the magnetic strip or from the EMV chip (those new chips inside of every card), to their processor.

- The processor verifies the purchase and the information that was provided by the merchant and sends a request to the card organization.

- Visa, or another one of the card companies verifies your information with the issuer (the ones that actually give the credit card, like Bank of America) and returns an “approved authorization” status to the processor/acquirer. Visa then charges the processor a fee (this is called interchange, and we will cover this right after this example) for transferring the funds from you to the merchant.

- The processor relays the “approved” status to the merchant, transfers the funds, and charges the merchant a fee called a transaction fee, which is how the processor makes money for facilitating transactions.

Several other small steps are involved, but this is the basic foundation of knowledge you’ll need to understand how credit card processing works.

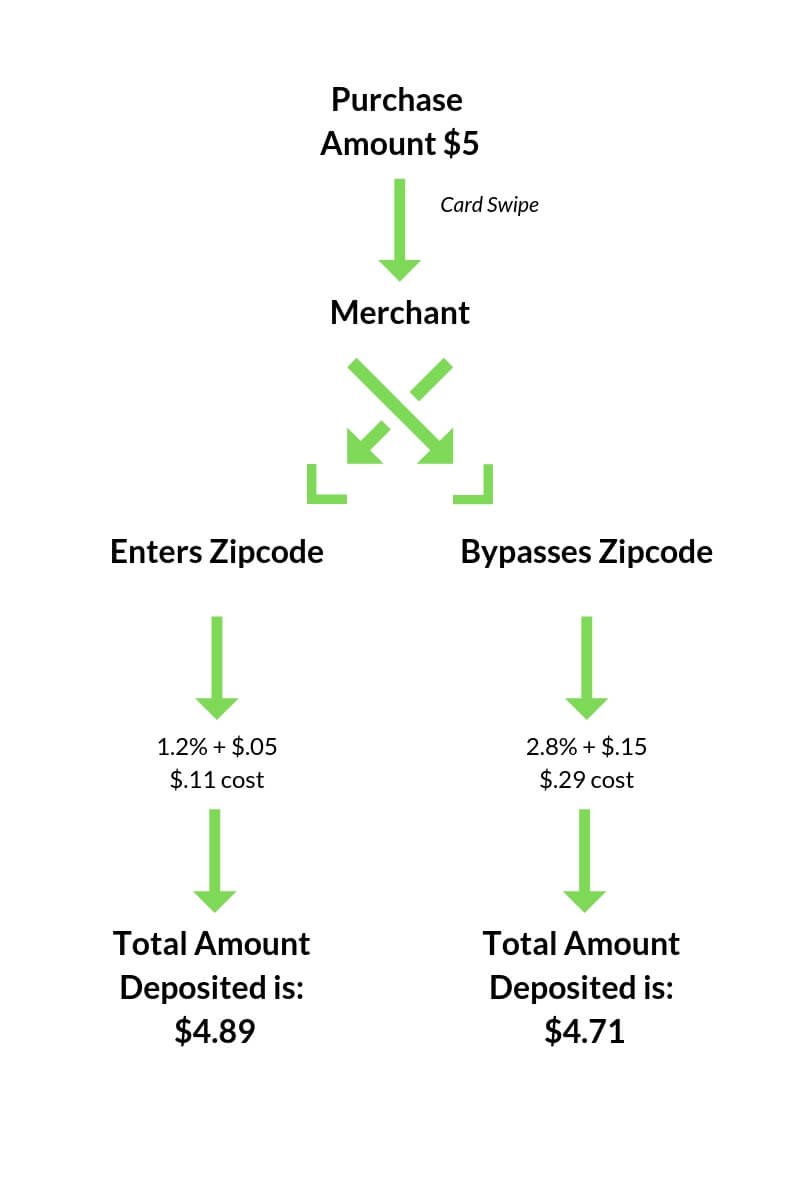

Over the course of an entire month, a coffee shop could save $.18 based on a type of processor coding into their system. Now, it may not be the smartest idea to exchange speed for processing savings, but in the above example, if a coffee shop sold 1,000 coffees in a week, they could save $180 by entering a zip code.

The more information in a transaction and the more secure the better for card processing rates. I bet you’ll start to notice which industries ask for zip codes and which ones prioritize speed of purchase now.

Before we go much further, we should define some important terms.

Credit Card Processing Industry Definitions

CC processing businesses will throw out jargon all the time, so it’s important to have an understanding of the key terms, not just for the purpose of this article, but also so you can understand your own processing statements or a proposal from a rival credit card processor.

-

- Interchange: The cost of a transaction set by the card organizations and by the processor. Interchange usually includes a percentage of the total transaction in addition to a per item fee, and this is usually set after calculating “risk.”

- Discount: The discount rate is one of two possible fees that the processor charges a merchant on each transaction. The discount rate is a percentage of the transaction amount (if a transaction is $100 and the discount is 1.2%, then the cost is $1.20).

- Per Item Fee: This fee is the second of two possible processor fees charged per transaction (the other being the discount rate). This is a flat fee the merchant pays for each transaction. This could range from $.05 to $.30 for most merchants.

- Volume: The total dollar amount of transactions processed within a given time frame.

- Transaction Risk: The amount of risk associated with processing and transferring funds. High Risk merchant processing exists when a certain level of risk is calculated. Risk is generally determined by chargeback likelihood. A processor could be on the hook for paying for chargebacks, and if the chargeback amounts are large enough in a given month, it can be a huge issue. You may be asked to have a reserve so your processor can dip into this amount in order to cushion their risk.

- 4 Tier Pricing: One of the types of fee structures for merchants. This model creates four buckets for the hundreds of card types to fall into. A certain range for the transaction cost is averaged and instead of experiencing vastly different charges, you’ll generally just see four rates with associated per item fee.

- Offline Debit: The cheapest of 4 tier pricing. This tier can cost as little as .25% and $.05 per item.

- Qualified Tier: The qualified tier is for secure transactions from low reward cards. This is usually a pretty low rate. Square charges a blanket 2.75% on all transactions, but tons of industries have the majority of cards fall into this bucket. We generally see 1.75% +.10 as the typical rate, but this can change depending on a variety of factors.

- Mid-Qualified Tier: This tier starts at about 2.00-2.30%. A secret of the trade is to advertise a super low fee for mid-qualified (or for another tier) and make it appear that you are cheap, but in reality, the merchant doesn’t receive any mid-qualified cards at their business. This is one of the reasons why processors ask for credit card processing statements. Without a statement, you can’t establish the card types and ranges for that particular business.

- Non-Qualified Tier: This tier is common for card-not-present transactions or for high rewards cards.

- Chargeback: This is when a consumer contests a charge. If your industry or your particular company has a high % of chargebacks, then you’ll have a difficult time getting a processor, and you do, you’ll usually get higher rates.

- POS (not to be confused with a piece of sh*t): This is a point of sale system. Restaurants have had these for years, but today, instead of a traditional credit card terminal, you can opt to get an iPad POS and process payments through that instead.

- Batch: This is VERY important for a merchant to understand. Batches happen when you group all the accumulated transactions that have been captured during a period of time (since all swipes are recording data – which is why PCI compliance is so important). The data hasn’t been transferred to the bank account, so a batch will get the merchant their money. Most merchants batch every night automatically, but you can also manually batch whenever you’d like.Another term associated with “batching” is “settlement“. Settlements have three steps.

1. Authorization: Customer is approved for purchase.

2. Capture: The moment a merchant passes a batch of authorized payments to the network. First Payment Services defaults to a 3 AM batch, but you can elect to manually batch or customize your batch times. Pro tip – Some people batch earlier in order to receive their money quicker. If you batch before certain times you can receive funds even quicker.

3. Settlement: The captured transactions are pulled from customer accounts and moved to the merchant account. You might have noticed small $.05 or similarly sized charges show up as “pending transactions” – this is an authorization charge and they drop off. Its similar to email verification when you sign up for a product.Another interesting fact: Bars and hotels swipe your card and store the data from the card via authorization – but they don’t actually process the payment. The settlement process explains how this works. Personally, when I learned all of this, I was fascinated (but I also just love to learn).

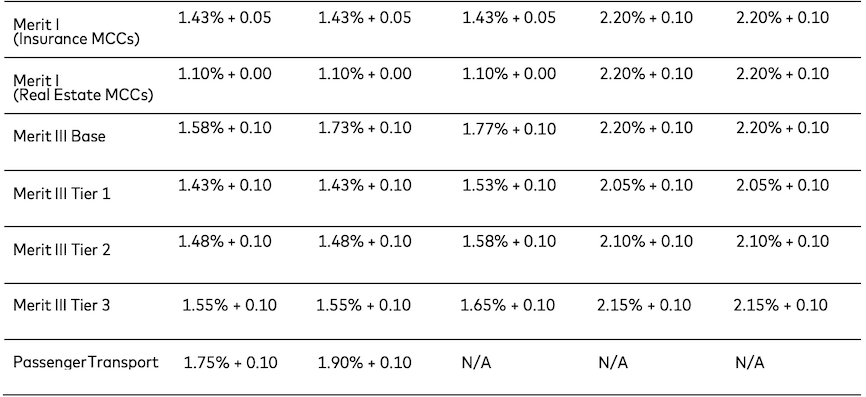

For a list of processing rates, check out the helpful list that MasterCard provides. They have a download link which contains a pdf that goes through some of their interchange rates. This will be very helpful in establishing a baseline familiarity with the industry and processing rates. As a quick reminder, these rates are charged to the processor first, so in a way, a processor becomes a micro-lender that pays for something but then reaches back around and gets their money through one of the processing fee types.

Square Vs. First Payment Services: An Educational Guide to Evaluating Processors

We’ve covered the basics of processing, so now its time to actually dig into a real-world example.

Square does a fantastic job of marketing. They capture the aesthetic zeitgeist with its minimalistic presentation and with its minimalistic fee structure (in other words, Square does a good job of harnessing the marketing trends of today and making itself look minimal and simplistic).

Lets start with rates:

Square: 2.75% and 3.50% + $.15 per transaction.

First Payment Services: Interchange + .20 per transaction for all cards.

If you read those mastercard listings of rates, you’ll quickly notice something –>

Row 1 = Name of Card | Row 2 = Base Rate (Qualified) | Row 3 = Tier 2 | Row 4 = Tier 3 | Row 5 = Tier 4 | Row 6 = Tier 4 + Card not present

SO what does all of this mean? You can see why some people prefer Square to a traditional credit card processor.

For many businesses, they have a majority of their transactions fall into qualified transactions. Many even have lower rates than these for debit transactions. It really just depends on the industry.

For Card Not Present or CNP, it means that you will be far better off using First Payment Services. Lets say you get a qualified card that falls into non-present. You wouldn’t trigger the most expensive tier. You would fall around the third tier. Lets take Merit III Tier 3 1.65% +.10 as an example.

If you ran this card by typing in the credit card numbers, you would run a bill of 1.65% +$.30 with First Payment Services.

If you ran the same card with Square the bill would be 3.50% + $.15. Lets say the bill was $120 for a pair of Nikes.

Square Cost: $4.35

First Payment Cost: $2.28

Imagine that you sold 100 Nike shoes in a month under these conditions.

The price difference? $223.65

This can be a massive blow to many merchants. Will your statement look more confusing with First Payment Services than with square? Sure. Will your bill be lower? Most definitely.

In the spirit of honesty, I will say this. We will never lie to a merchant about whether we can beat their current rates. We can do rate locks that legally (contractually) force us to keep our rates what we promised and why in the world would we expect a merchant to stay with us after they notice their bill go up? Answer – They wouldn’t…you wouldn’t.

But price isn’t everything.

Lets evaluate another important bit about processing.

In terms of approval process for highisk merchants. FPS beats Square.

Customer Service: FPS has a dedicated rep assigned to our accounts, so you will have someone familiar with your business between the hours of 9-5 Central time.

What if you have issues outside of 9-5? Well, at that point we have equivalent customer service with Square and use an experienced call center.

How about the realllllly important issue for merchants – timeline for fund deposits.

Once again, First Payment is on top with 24-48 hour turn around times for deposits. Unusual transactions may take longer, but this is normal to the industry as a security precaution to protect the merchant.

Contracts? We’re a bit tied on that one. No contracts for either company, although, we offer the ability to sign a contract, which enabled you to get some pretty heavy duty equipment for free of charge.

Square allows a free mobile processor, but this is not EMV friendly (a mandated rule that removes some risk away from the merchant – the little chip in your card).

Conclusion

Credit card processing has a lot of moving parts and is a confusing beast to say the least. But! if you take the time to learn the basics, it can clear up a lot of the mystery behind credit cards and it will help you save money on processing fees.

In the end, merchants choose what they trust and choose the path of least resistance. We just hope, that the least resistant path isn’t the more expensive path, because often times, thats precisely the case.

Copyright 2019.

– by First Payment Services, a Credit Card Processing Company and ISO of Synovus. All Rights Reserved.

All content on this web site is original content from First Payment Services.

Credit Card Processing rates are variable based upon the particular credit cards used by each merchant. Credit card processing rates quotes in this article are indicative of the average rate across all credit card processing accounts. For a binding processing quote, submit all merchant card inquiries to https://firstpaymentservices.com/contact-us/